Energy storage cabinet converted to solar power generation credit

Welcome to our dedicated page for Energy storage cabinet converted to solar power generation credit! Here, we have carefully selected a range of videos and relevant information about Energy storage cabinet converted to solar power generation credit, tailored to meet your interests and needs. Our services include high-quality Energy storage cabinet converted to solar power generation credit-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

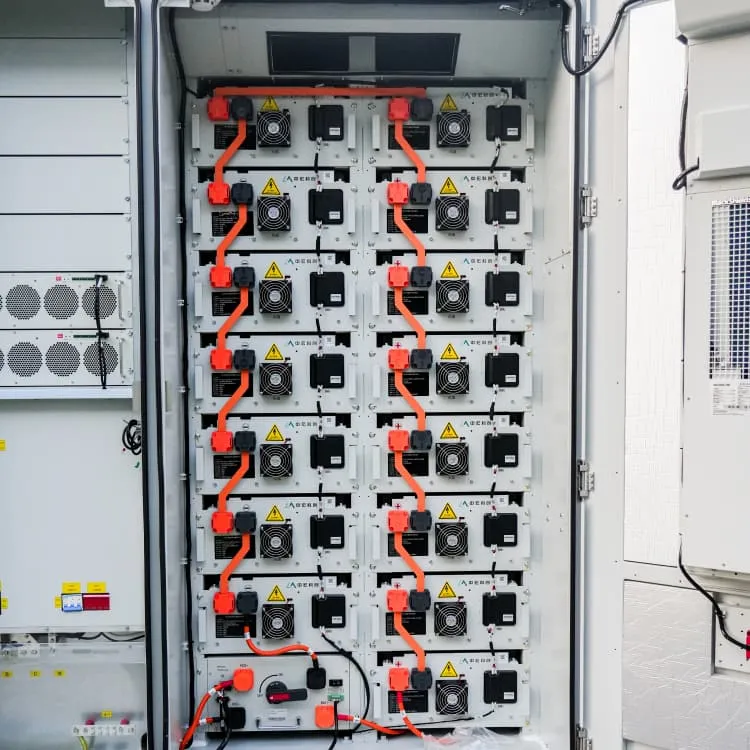

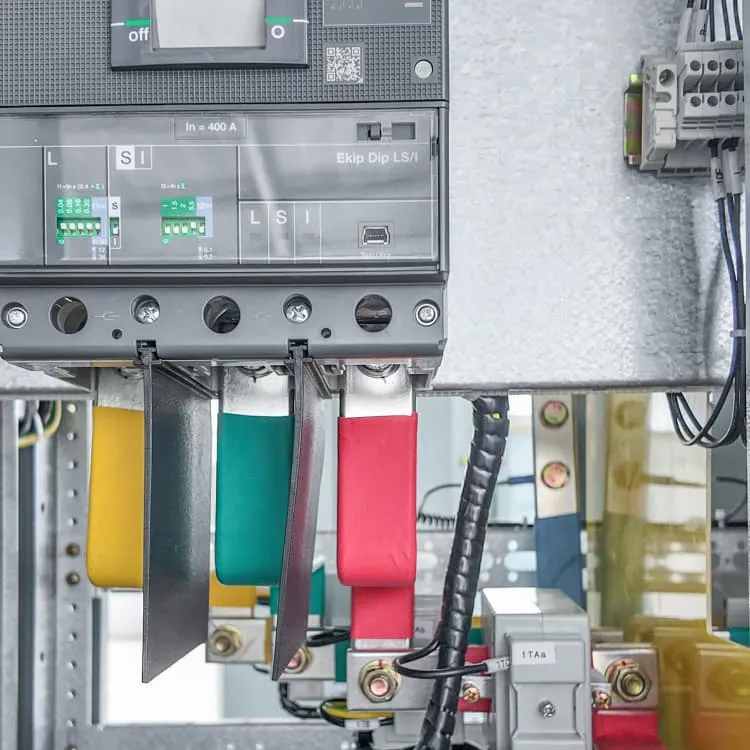

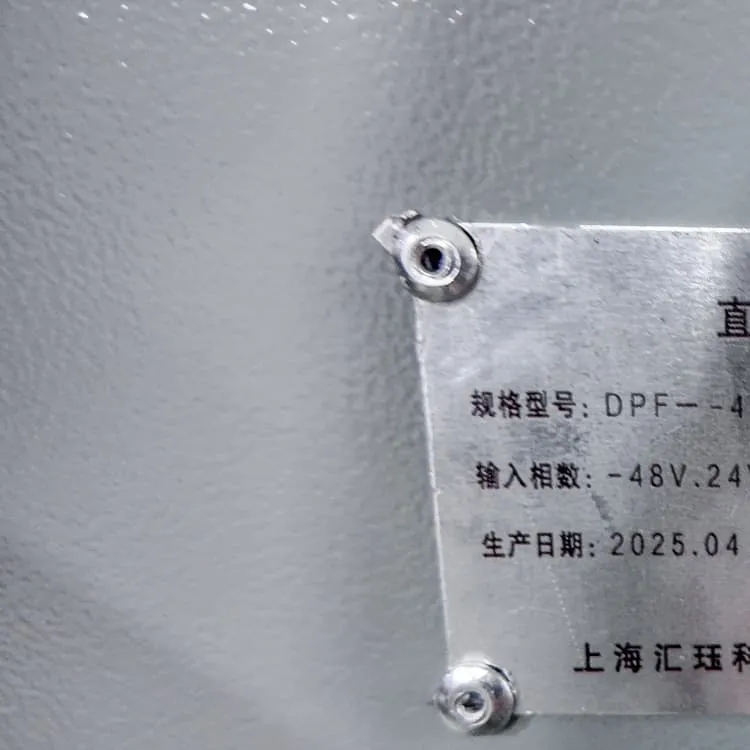

Wherever you are, we're here to provide you with reliable content and services related to Energy storage cabinet converted to solar power generation credit, including cutting-edge solar energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

The State of Play for Energy Storage Tax Credits – Publications

This guidance has provided welcome clarity for sponsors, investors, lenders, credit buyers, equipment vendors, service providers, and tax credit insurance providers, allowing for

Residential Clean Energy Credit & Home Battery Systems

Battery storage tax credit and solar tax credit fall under the same legislation: "The residential clean energy credit". The residential clean energy credit is the only official name. It

What are the specific requirements to qualify for the federal tax

Expanded Eligibility: The Inflation Reduction Act expanded eligibility for standalone energy storage systems beyond those connected to solar, allowing for a broader range of

Inflation Reduction Act Creates New Tax Credit Opportunities for Energy

Energy storage installations that begin construction after Dec. 31, 2024, will be entitled to credits under the technology-neutral ITC under new Section 48E (discussed below).

FAQs 6

What tax credits are available for solar energy installations?

There are two federal tax credits that incentivize solar installations: (1) the Section 48 Investment Tax Credit (ITC) available to businesses who invest in solar energy systems; and (2) the Section 25D residential credit that may only be claimed by individuals who purchase a solar energy system or a standalone energy storage system for their home.

Are energy storage technologies eligible for 48 credits?

Other modifications to definitions include, but are not limited to, the following: Energy storage technology is eligible for the §48 credit if it satisfies the requirements, notwithstanding that it may be co-located or shared by a facility that is otherwise eligible for §45, 45V, or other 48 credits.

How has the energy storage industry progressed in 2024 & 2025?

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits enacted under the Inflation Reduction Act of 2022 (IRA).

Who can claim energy storage credits?

Taxpayers with a qualified facility and energy storage technology placed in service after Dec. 31, 2024 may claim the credit. Elective payment and transfer of credits may be available to certain applicable entities to include tax-exempt organizations and government entities.

Do energy storage projects qualify for a new ITC?

Energy storage projects placed in service after Dec. 31, 2022, that satisfy a new domestic content requirement will be entitled to a 10% additional ITC (2% for base credit).

How do I claim a residential energy credit?

File Form 5695, Residential Energy Credits with your tax return to claim the credit. You must claim the credit for the tax year when the property is installed, not merely purchased. For additional instructions on how to claim the credit for residential clean energy follow our step-by-step guide.

Random Links

- 10KW motor inverter

- Actual cost of energy storage batteries

- The ultimate solution for energy storage

- Danish 12v 300ah energy storage battery

- Guinea-Bissau heavy industry energy storage cabinet supplier

- Home energy storage power supply costs

- Albania DC energy storage equipment

- What devices can outdoor power supplies be used for

- 12v to 36v universal inverter price

- Wind and solar power inverter

- Water Pump Inverter High Power Solar

- Affordable photovoltaic outdoor solar energy

- Cook Islands Energy Storage Inverter

- The latest price of energy storage cabinet batteries

- Outdoor power supply plus DC power

- Afghanistan three-phase inverter manufacturer

- How much does it cost to join the site energy battery cabinet franchise

- Southeast Asia Outdoor Battery Cabinet BESS

- Photovoltaic panel greenhouse manufacturer in the Democratic Republic of Congo

- Digital Energy Photovoltaic Inverter

- Industrial energy storage high-power battery

- 15W solar all-in-one machine

- 5G base station battery demand

- Bulgaria Looking for Wind Power and Photovoltaic Energy Storage Projects

- 100MW battery energy storage investment

- Point-to-point communication base station inverter grid connection

- How to pair a battery inverter

- How much is the price of photovoltaic panels for North Asia villas

- Solar automatic water pump inverter

- Inverter connected to the battery