Ratio of investment income of energy storage projects

Welcome to our dedicated page for Ratio of investment income of energy storage projects! Here, we have carefully selected a range of videos and relevant information about Ratio of investment income of energy storage projects, tailored to meet your interests and needs. Our services include high-quality Ratio of investment income of energy storage projects-related products and solutions, designed to serve a global audience across diverse regions.

We proudly serve a global community of customers, with a strong presence in over 20 countries worldwide—including but not limited to the United States, Canada, Mexico, Brazil, the United Kingdom, France, Germany, Italy, Spain, the Netherlands, Australia, India, Japan, South Korea, China, Russia, South Africa, Egypt, Turkey, and Saudi Arabia.

Wherever you are, we're here to provide you with reliable content and services related to Ratio of investment income of energy storage projects, including cutting-edge solar energy storage systems, advanced lithium-ion batteries, and tailored solar-plus-storage solutions for a variety of industries. Whether you're looking for large-scale industrial solar storage or residential energy solutions, we have a solution for every need. Explore and discover what we have to offer!

How can I calculate the return on investment (ROI) for energy storage

The ROI is determined by assessing the profitability of the investment relative to its costs, measuring the effectiveness and efficiency of energy storage solutions in reducing

Solar Investment Analysis Part 1: Estimating System Production

Asessing System Cost Investing in a photovoltaic solar energy system is a major investment that will influence the future profitability of a farm or ranch. In many ways, investing in a solar

Third Annual Energy Supply Investment and Banking Ratios

Executive summary The energy industry is shifting more of its investment into cleaner sources of supply. Bank financing for low-carbon energy supply technologies reached 89% of that for

Economic evaluation of battery energy storage system on the

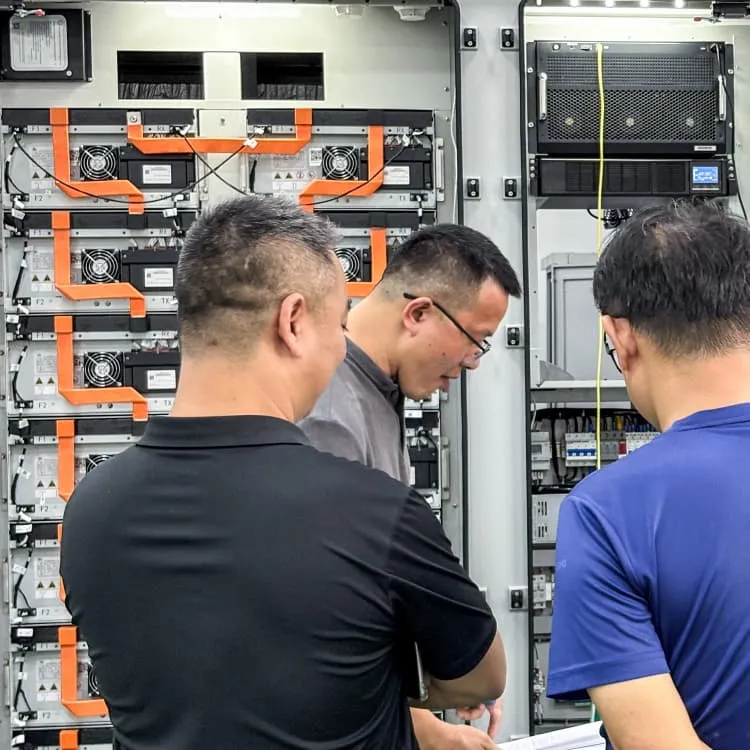

The cost of investment in BESS usually includes the initial cost and the replacement cost, and the former refers to the one-time fixed investment at the initial stage of the BESS

Research on investment decision-making of energy storage

1 day ago· Research on investment decision-making of energy storage power station projects in industrial and commercial photovoltaic systems based on government subsidies and revenue

Understanding the Return of Investment (ROI) of Energy Storage

In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the

Energy Storage Financing: Project and Portfolio Valuation

This study investigates the issues and challenges surrounding energy storage project and portfolio valuation and provide insights into improving visibility into the process for developers,

FAQs 6

Is energy storage a good investment?

As energy storage becomes increasingly essential for modern energy management, understanding and enhancing its ROI will drive both economic benefits and sustainability. To make an accurate calculation for your case and understand the potential ROI of the system, it’s best to contact an expert.

How does energy storage affect Roi?

The cost of electricity, including peak and off-peak rates, significantly impacts the ROI. Energy storage systems can store cheaper off-peak energy for use during expensive peak periods. Subsidies, tax credits, and rebates offered by governments can enhance the financial attractiveness of ESS installations.

What factors influence the ROI of a battery energy storage system?

Several key factors influence the ROI of a BESS. In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to keep in mind: internal factors that we can influence within the organization/business, and external factors that are beyond our control.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Should energy storage project developers develop a portfolio of assets?

12 PORTFOLIO VALUATION Developing a portfolio of assets can be seen as the inevitable evolution for energy storage project developers and private equity investors who are interested in leveraging their knowledge of the technology, expertise in project development, and access to capital.

Are energy storage projects different than power industry project finance?

Most groups involved with project development usually agree that energy storage projects are not necessarily different than a typical power industry project finance transaction, especially with regards to risk allocation.

Random Links

- Russian outdoor communication battery cabinet custom supplier

- Bhutan lithium battery portable energy storage recommendation

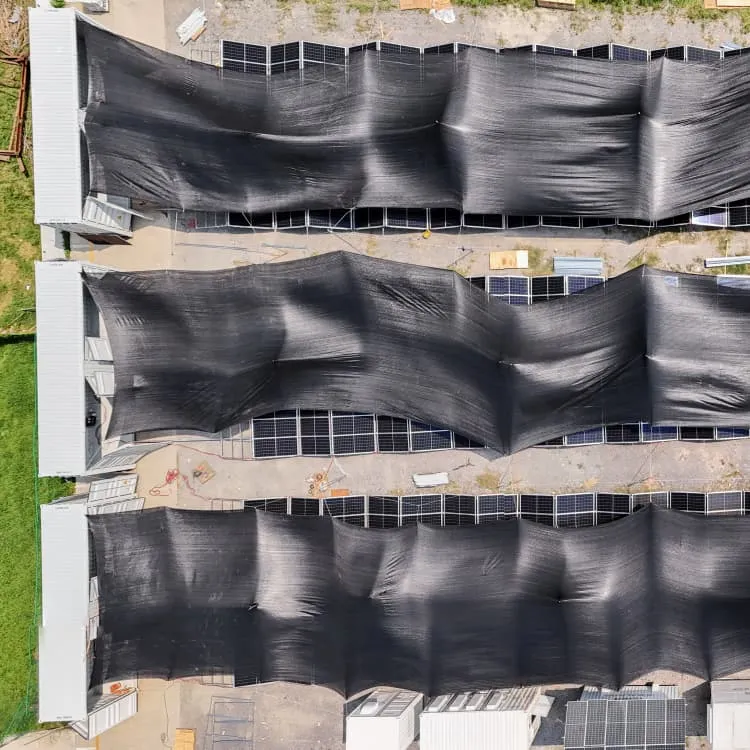

- Photovoltaic energy storage container applications

- Lithium titanate batteries for 5G base stations

- 800w 24v inverter

- What are the energy storage batteries for island investment

- Zambia energy storage cabinet

- Energy storage cabinet battery private placement

- Photovoltaic curtain wall building design in Brazil

- Cost price of Moldova energy storage container factory

- Hybrid Energy 5G Base Station Distributed Power Generation

- Benin container energy storage transformation

- Mauritania Wind and Solar Storage

- Huijue South Asia Energy Storage Project

- Introduction to Solar Energy Storage Equipment

- Huawei s wind solar and energy storage system composition

- Flow batteries replace lithium batteries

- China-Africa Energy Storage Battery Store

- High-power photovoltaic energy storage power supply wholesale

- All-vanadium liquid flow battery equipment

- Can the battery BMS boost voltage

- Boston pure sine wave inverter

- Burkina Faso s new solar photovoltaic panels

- Flywheel energy storage occupies

- Luxembourg Energy Storage Container Customization Company

- What electricity does a commercial photovoltaic power station use

- Which base station is used for hybrid energy 5G

- Energy storage 20-foot site container

- Seychelles portable power supply manufacturer

- Central Asia Industrial Park Energy Storage Application Market